In the UK, we see sustainable growth in demand for elderly care, constrained supply of beds and a highly fragmented market, coupled with rising fees and the prospect of further government funding. This creates an attractive long-term opportunity for well-capitalised asset owners to achieve scale by acquiring high-quality resilient homes, while working in partnership with well-managed operators who are committed to providing high standards of care.

2020 market value £17.3bn

| total | £8,071m |

|---|---|

| for profit | £7,281m |

| not-for-profit | £791m |

| total | £7,489m |

|---|---|

| for profit | £5,930m |

| not-for-profit | £1,559m |

| state-run | £1,069m |

| state-run | £689m |

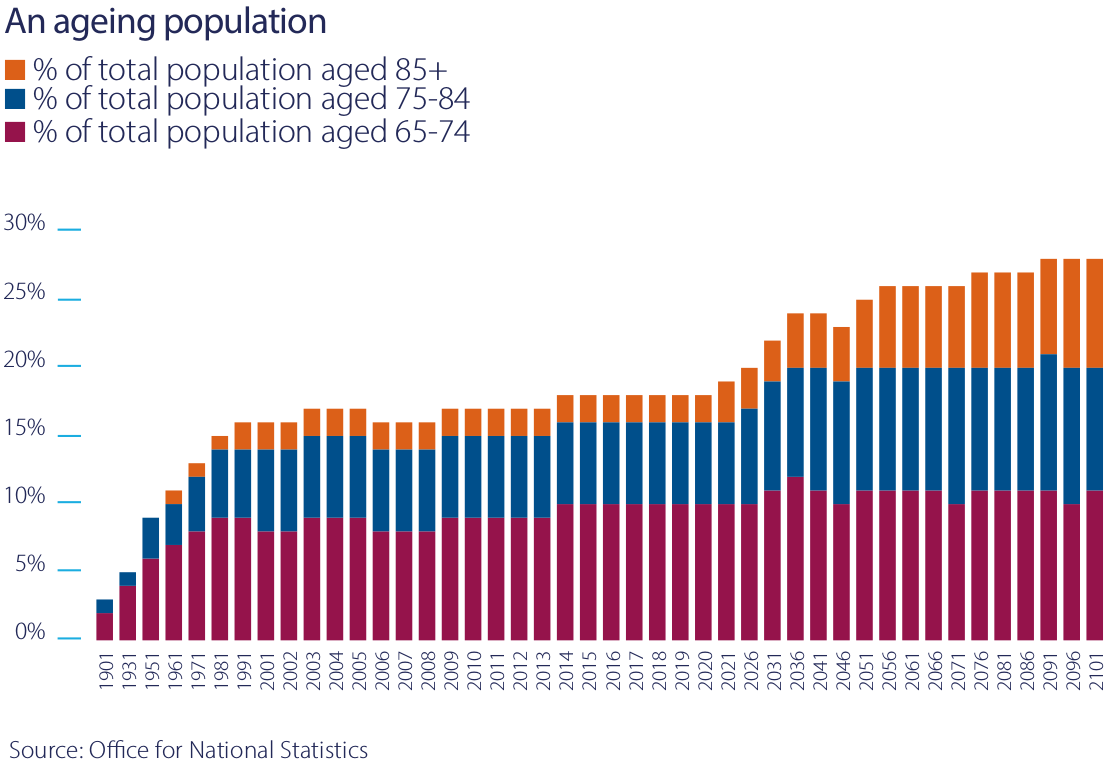

People aged over 85 are the fastest-growing part of the UK population and make up the core client group for care homes. According to the Office for National Statistics, the proportion of the population over 85 years old in the UK is forecast to more than double over the next three decades, from 2.5% in 2021 to 5.2% in 2051.

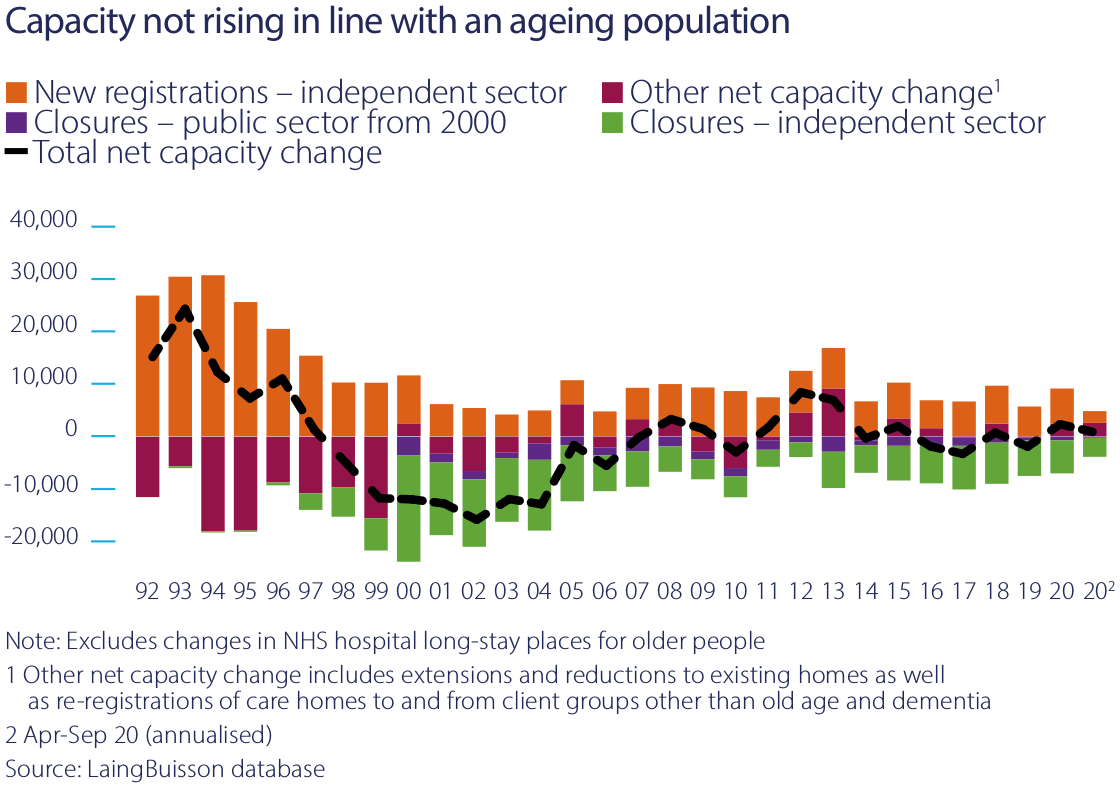

The COVID-19 pandemic has reduced occupancy in care homes in the short term. However, over the medium and longer term, demand for elderly care is forecast to grow. Research by LaingBuisson, a leading consultancy in social care, forecasts that up to an additional 93,000 beds will be required to satisfy this increased demand over the next ten years, an increase of over 20% on demand today.

Since 2013, the number of new beds built has equalled beds being withdrawn from the market. Underlying this stability there have been a number of changes in the structure of the market.

Independent operators, both for profit and not-for-profit, have continued to take market share from homes owned and operated by the public sector. At the same time, the number of care homes has shrunk by 9% between 2010 and 2020 as older, obsolete buildings are withdrawn from the market to be replaced by more modern, larger homes. The average size of care homes has grown from 36 beds to 42 beds in that period. The average size of homes in Impact’s portfolio is 50 beds.

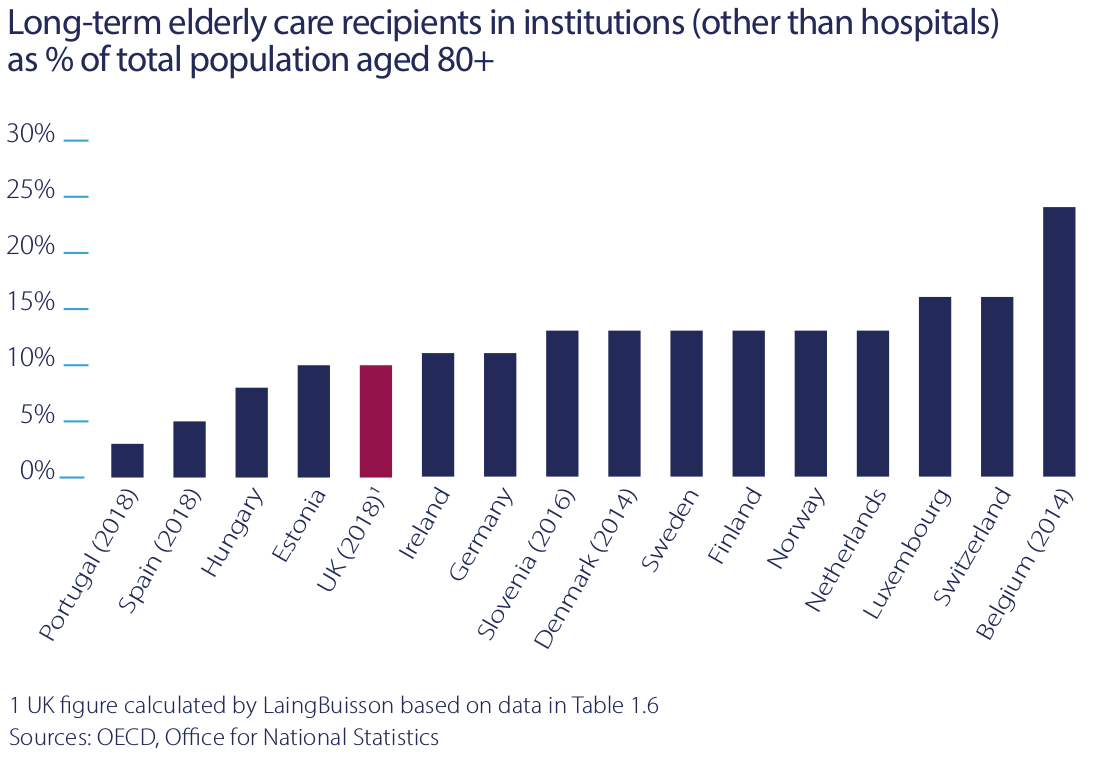

In the UK, 10% of people over 80 have long-term care needs, which can best be delivered in a care home. In other north European countries, the percentage of people receiving care in care homes is substantially higher.

There is no evidence older people in the UK are healthier than in neighbouring countries. The lower proportion of older people in care homes might instead show that current UK government policy is effective in rationing access to care homes only to those who absolutely need that care.

The UK care home market is less susceptible to competition from other forms of care provision and as overall demand increases, so should the demand for care home beds.

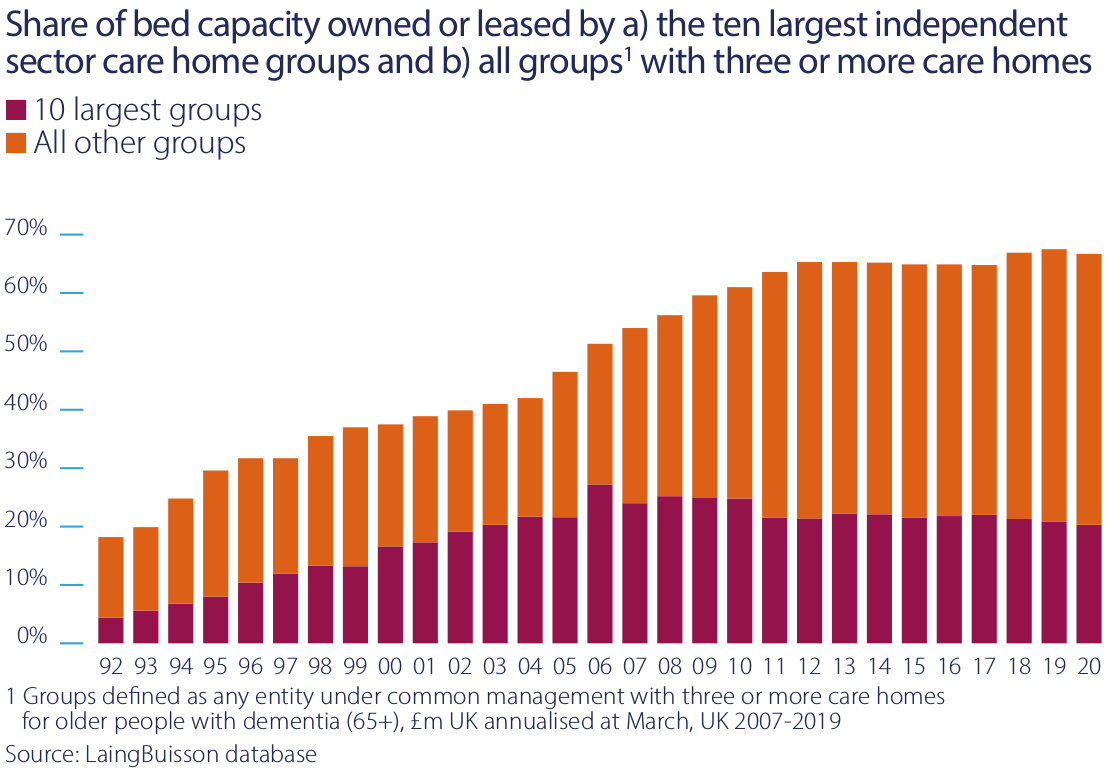

Over recent years the market has seen deconsolidation at its top end. The market share of the ten largest independent operators has declined from a peak of 27% in 2006, to 20% in 2020. This reflects diseconomies of scale in the care business. For the largest operators, the potential benefits of access to capital at lower cost and purchasing power for consumables such as utilities and food tend to be more than cancelled out by higher group overheads and the lack of economies of scale in pay rates for care staff, which are operators’ largest expenditure.

Over the same time period from 2006 to 2020, the market share of sole traders with between one and two homes also shrank. Mid-sized groups, which operate between 100 and 4,000 beds as local or regional clusters, have been more vibrant, growing their market share from 24% to 47%. Most of Impact’s tenants are active in this part of the middle market.

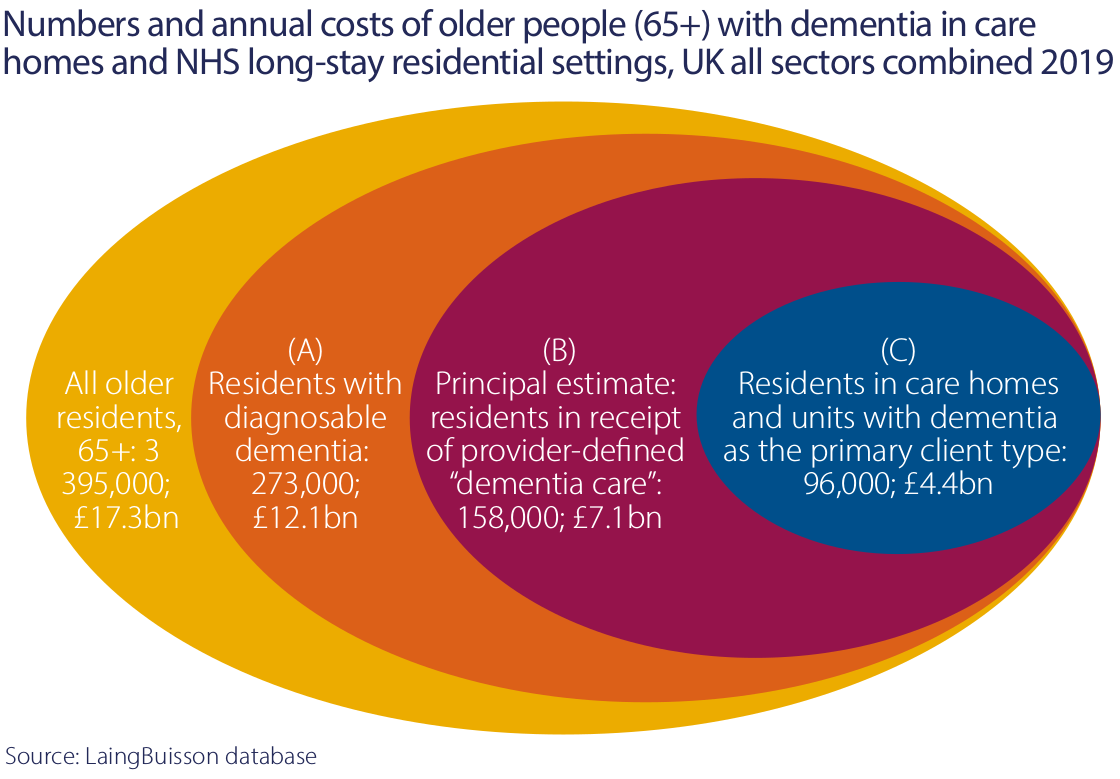

The Alzheimer’s Society estimates that in 2020 there were 850,000 people in the UK with some form of dementia, “with the number set to rise to over one million by 2025 and two million by 2051”.

An estimated 69% of the residents in care homes in 2020 had some form of dementia and 96,000 residents had acute dementia, which required a specialised level of care. As our understanding grows on how to provide good care for people with dementia, there has been more emphasis on building dedicated units to provide this care. That has been a particular focus of our asset management activities.

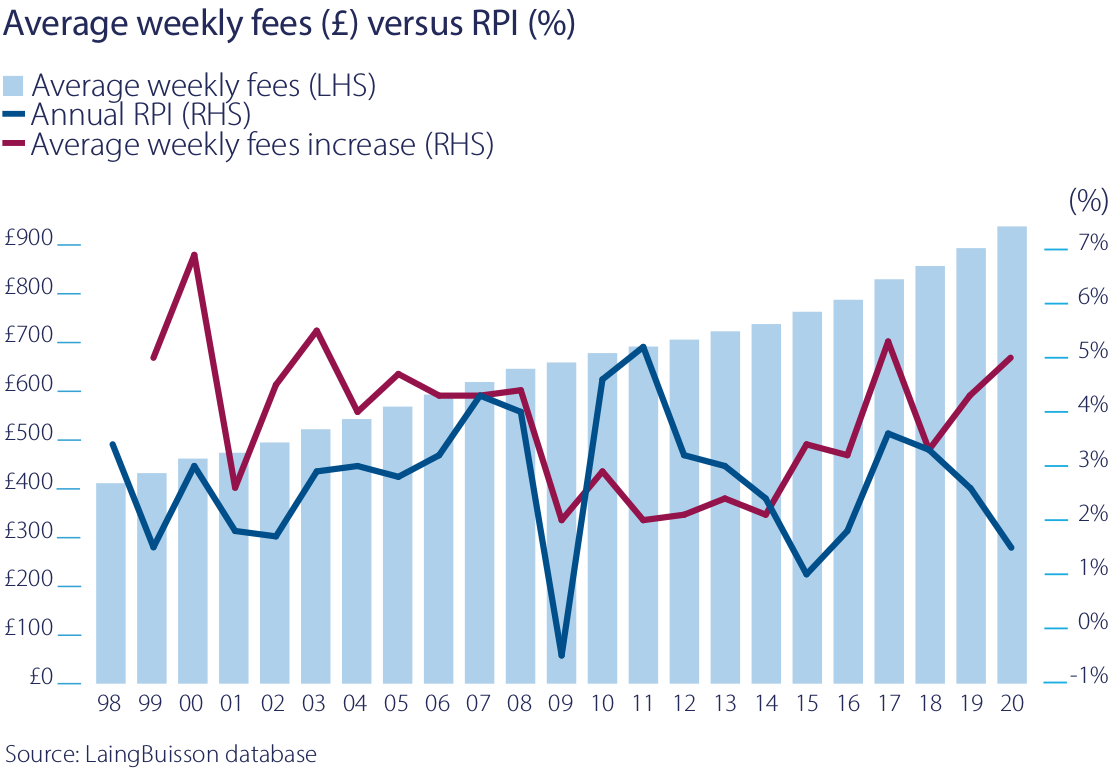

As a result of increasing demand, limited new capacity and a shift from government provision to independent providers, the independent sector has seen sustained and above-inflation growth of the fees it charges for care. Between 1998 and 2020, weekly fees charged by operators have grown on average by 3.8% per annum for nursing care and 3.7% for residential care. Over the same time period, RPI has averaged 2.8% per annum. This gives us confidence that the RPI linkage in our leases is sustainable.